The NFL Jaguars and Jacksonville officials are still hammering out the specifics of the stadium restoration, and it looks like the project would be less expansive than the team’s ambitious 2023 plan, which claimed taxpayers would be responsible for spending over $1 billion.

In the meanwhile, a creative method of financing the transaction would prevent the city from needing to raise all of the money through the bond market, which might assist to resolve another persistent problem for the local government.

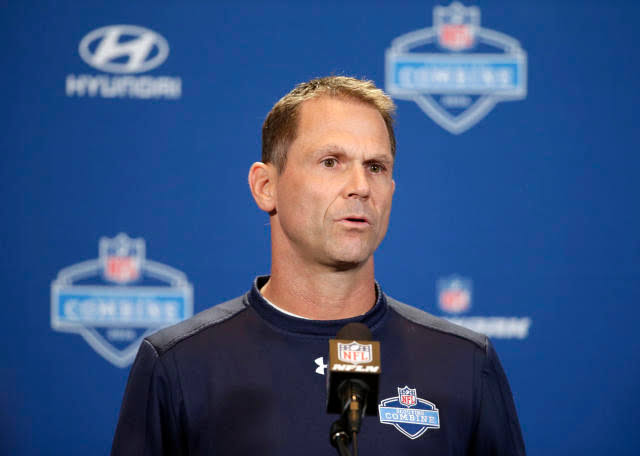

Mike Weinstein, the head negotiator, informed Florida Politics that the stadium district that the team had hoped to include in the deal is not on the table.

Regarding the negotiations, Weinstein stated, “It’s just a stadium,” adding that the team and the city “havenever had a serious conversation about the property” surrounding the stadium.

Because to its location in a Community Redevelopment Area, “many legal steps that need to be taken” are required.

Introducing competition for development would be one of those actions.

Weinstein stated, “It has to be made public,” adding that neither Shad Khan nor the Jaguars are considering “property rights” as a result of this deal.

The Jaguars and Shad Khan’s “Iguana Investments” previously projected a $2.068 billion total investment, which could include improvements to the stadium costing between $1.2 and $1.4 billion and the creation of a “sports district” costing between $550 and $668 million. It was suggested that Jacksonville pay for two thirds of the stadium upgrades, with a 50/50 cost split on the entire undertaking.

According to Weinstein, that’s currently up in the air.

Weinstein declared, “We won’t go to the public or the council without a logical and justifiable split. We’re knee-deep in negotiations, and I can’t do it through you.”

We’re in the thick of discussions, and I can’t get through to the public or the council without a rational and convincing division, Weinstein stated.

According to Weinstein, the stadium’s final cost is unknown because it hasn’t been “fully designed.” Questions are thus left open.

“Until something is truly totally designed, it is not fully designed. Really, you have no idea how much it will cost. You have no idea how many of the components will be expensive, whether the temperature will drop as much as it needs to, or how the roof will function.

The city is currently investigating innovative financing options, such as leveraging assets from the General Employees pension fund and the Police and Fire Pension Fund, which together, according to Weinstein, have $5 billion in assets that could be lent to the city for this deal and repaid at an interest rate that satisfies the PFPF targets.

According to Weinstein, although this rate would be higher than what would be achieved by traditional bond market financing, it would spare the city from having to pay fees and other expenses on the funds that were transferred from the pension fund to the infrastructure project.

“If it becomes viable, there is a chance that some of that, a small portion of that, could be invested in the city. That way, instead of investing in real estate or the stock market, they could put some of that money there and donate it to the city,” Weinstein said.

According to Weinstein, the city would guarantee principle and interest at their AAA return target in exchange.

A call option, or the ability to “call back” some of the pension funds’ cash reserves at any moment when they’re short on funds—which they never will be because they essentially have $5 billion in cash—would also be included in the deal.

“Therefore, even though the interest rate will be slightly higher than what we would receive if we go to the bond market for this, they will be protected if they do this, they will meet their target, they will invest in the city, and they will have the ability to call back if, in fact, they get into a cash problem for the city.”

However, there are costs associated with going to the bond market, including insurance, bond purchases, and other expenses. We must thus consider the difference between what we could obtain on the market and what we would guarantee to them. By paying ourselves instead of all the additional expenses, we would essentially be assisting the pension fund in closing more quickly.

According to Weinstein, Jacksonville may issue its call and “put it in the financial marketplace” if interest rates decline to make borrowing from outside city sources more attractive.

He pointed out that since the plan has “zero connection” to workers and unions and that the police and fire talks are anticipated to be concluded before stadium funding becomes a concern, this is a different matter from the labor talks that are now taking place with public safety unions.

It has been indicated by Mayor Donna Deegan that an agreement will be prepared for presentation to the City Council this summer, marking the change in leadership between Ron Salem and Randy White.

It is the start of summer in Salem. Weinstein stated that “the new President, whoever that is, will have it at the end” and that in the end, Salem “be the one that manages the stadium process through Council.”

Weinstein feels that despite the tense relationship that has existed between Salem and the Mayor’s Office, it “in no way hampers or interferes with the process that we’re under.”

Similarly, he speaks with Mark Lamping, the president of the Jaguars, approximately once a week.

“I have to say that it’s been a very cordial and very good process with the Jaguars, and we want them here as well. I’m pretty confident we’re going to end up with an agreement.”